Better decision-making starts with advantaged insights

The #1 resource for data analytics, bespoke for every bank

Strategic Management. Performance Management. Mergers and Acquisitions.

Better, faster value insights

Bespoke to your bank’s footprint

Integrates deposit, mortgage, financial, and demographic data at the ‘bank x local market’ level

Push of the button market and competitive analytics

Organic and inorganic growth screens and ‘what-if’ simulations

Predictive performance analytics – expected vs. actual

Downloadable outputs to aggregate with internal information

Easy access to standard reports: market and bank specific

Access to insight on your bank (and all 4,000+ US banks)

Includes all 4,000+ US banks, 88,000 branches, and 20,000 zip codes

Proprietary, value-based offerings that support decision-making

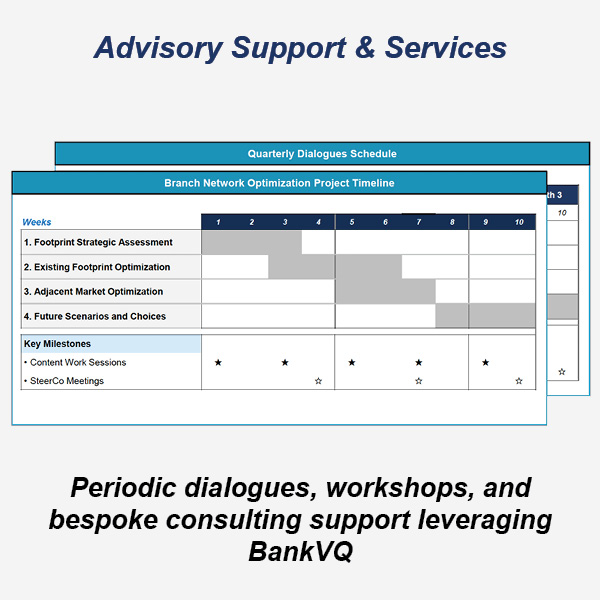

Multiple ways to tap into BankVQ